Home » 3 Questions I Ask Every Real Estate Operator

3 Questions I Ask Every Real Estate Operator

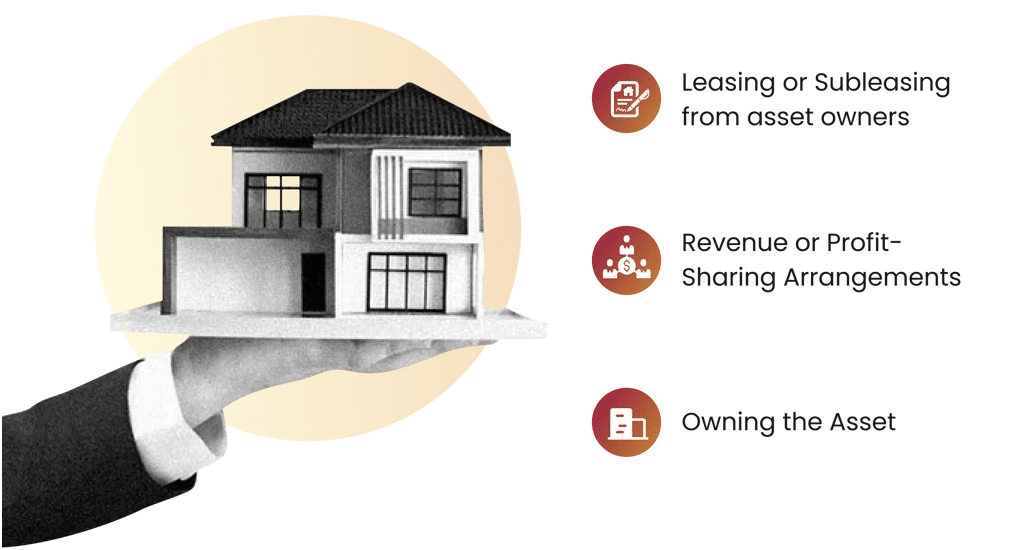

1. What is your relationship with the asset you are operating on?

Given what I do, I have the privilege of meeting or speaking with atleast 3-5 real estate operators every week. As an entrepreneur whose business is already serving 100s of such operators, I believe I always have something to offer to them. In all these conversations, I try to get context about their business as quickly as possible, so I end up starting with these 3 critical questions, which I believe are the most critical for any real estate operator.

Leasing or Subleasing from asset owners:

In this model of engagement, the operator is the master tenant for the property who further subleases to others. This is a tried and tested mode of engagement and the default preference for most asset owners. In most scenarios, there is enough upside for operators to create value as well.

The big risk though is from low/no occupancy. During the pandemic, most operators following this model realized that they have taken on too much risk proportionate to the margins they have in the business as their commitments to paying landlords remains the same, even if their tenants aren’t paying them. This led to many bankruptcies as well.

From what we observe, most operators start their business with a lease-sublease model, but eventually try to move towards other modes of engagement as their business credibility gets better.

Operators with a high concentration of lease-sublease agreements have good margins, but carry a good amount of risk.

Revenue or Profit-Sharing Arrangements:

Operators in revenue or profit-sharing arrangements with asset owners is a partnership aimed at mutual benefit. In such agreements, the operator helps the asset owner in managing, maintaining and monetizing the real estate asset exchange for a share of the revenue or profit generated by the asset. This arrangement incentivizes operators to drive value creation towards the asset. However, It requires clear roles, communication, and fair division of earnings.

In theory, this is a great option for operators but most asset owners don’t prefer this for 2 reasons –

Unless the rent is guaranteed, the asset owner finds it hard to get good financing/loans for the building

It is hard for asset owners to plan their cash flow as their share of the revenue isn’t committed and varies month to month

So for an operator to convince an asset owner to work on a revenue share/profit share basis, they need to have a track record of executing well, and a strong brand positioning. Most of the hotel industry operates on a profit sharing basis, so it’s not unheard of.

Operators who have a high concentration of revenue/profit share assets have very low risk, but lower margins on the business as well

Owning the Asset:

Ownership of an asset gives control, autonomy, and potential for wealth creation to the operator so it’s hardly surprising that operators are increasingly looking at this model. In ownership models, operators have authority on operations, strategic direction, and capital expenditures. It also allows for long-term capital appreciation, brand positioning and potential alternate income streams, so it’s not surprising that ‘PropCo <> OpCo’ business models have been gaining popularity.

Asset ownership comes with its own set of challenges including management construction/development, financing-related challenges, legal and regulatory, etc. Most operators need to have maturity in this organization and a high level of credibility before venturing into this domain.

When we see operators in this business, it’s mainly Asset Owners (or people coming from a background of real estate development) who have decided to be an operator themselves, although many daring entrepreneurs from the operator world are asset owners too.

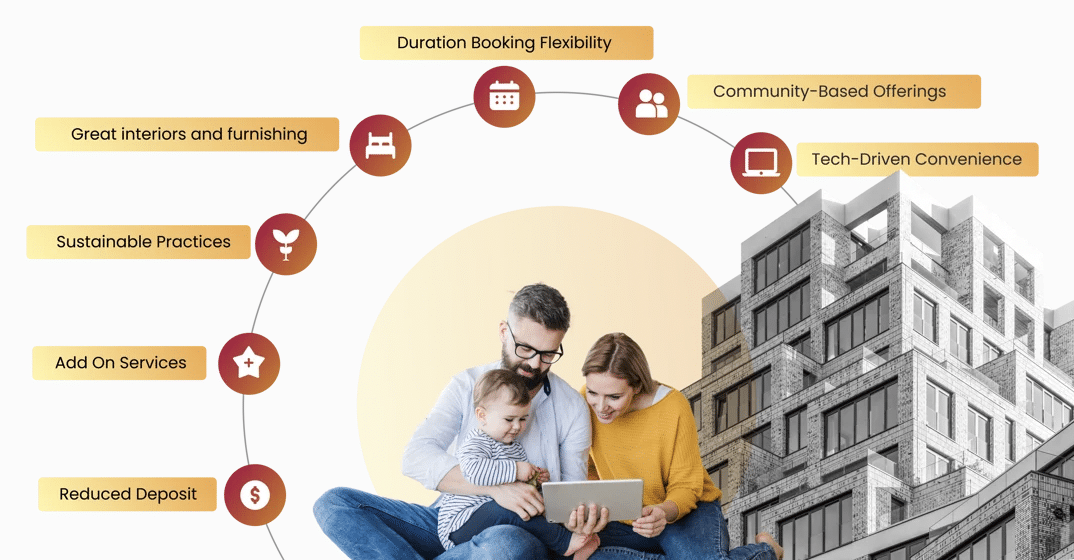

2. What is your value add to tenants?

Our take is that operators must distinguish themselves by offering unique value propositions to tenants. Beyond a space, what additional amenities do they bring to the table?

Great Interiors and Furnishing:

Whether a well-done office or a well designed coliving, great interiors is something all tenants look forward to but most lack expertise in. It’s a super important area of value added from an operator.

Add-on Services:

Operators can differentiate their properties by offering services which help meet the tenants’ needs. This may include housekeeping services, concierge assistance and maintenance support.

Allow Flexibility in Booking Duration:

Operators can provide flexibility in booking durations, allowing for short-term stays, extended leases, or even customizable rental agreements. In coworking, it starts with allowing tenants to book a hot desk for a single day (day pass), or in coliving it’s about allowing the tenants to book a room for a single night! The flexibility is much appreciated by all tenants.

Reduced Deposit:

Operators may offer reduced deposit requirements or alternative payment structures that ease the upfront costs associated with securing a rental property, which they might otherwise find hard to convince a legacy Asset Owner/landlord.

Community-Based Offerings:

Operators can enhance tenant satisfaction by creating engaged communities through curated events, booking of shared spaces, and offer community interaction virtually.

Sustainable Practices:

Operators can differentiate themselves by incorporating sustainable practices like energy-efficient appliances, and eco-friendly building materials and green spaces as it appeals to the environmentally conscious customers while contributing to the greater good.

Tech-Driven Convenience:

Operators can use technology to streamline operations, monetize more value, and enrich the tenant experience. This may include IoT systems, tenant engagement solutions, and tech-enabled amenities such as fitness centres and co-working spaces.

Overall, operators need to be more than just middlemen between landlords and tenants, and what they are offering tenants helps me understand how deeply they are committed to the ecosystem they are building.

3. What is your pricing strategy and positioning?

Many operators think of themselves as a middle ground between super-premium players and budget-friendly options. In most cases, I have learnt that it’s not wise to think about the positioning in this way. There will always be players who are priced more expensive or cheaper than yours, but it’s important to understand where you fall in the spectrum. Is the needle closer to the ‘Super Premium’ side or elsewhere?

It’s extremely important to know this as pricing directly affects occupancy, and positioning reflects on tenant expectations. If you are truly closer to a ‘budget friendly’ solution, you may get away without providing (say) housekeeping service, but that’s not possible in other segments. Similarly, you may able to push your tenants to route all communications and interactions through an app in the ‘semi-premium’ segment, but if you are truly a ‘super premium’ player, you have to give the ability for your tenants to just call a concierge/helpdesk and have their query/challenge addressed immediately.

In a market as large as real estate rental, there are always more than 3 segments, so I really want to know where operators want to position themselves. There is enough opportunity in any segment in the industry – it only becomes troublesome if an operator wants to simultaneously play in multiple segments.

To summarize, these three questions help evaluate how skilled and strategic real estate operators are. By diving into their relationship with assets, value proposition to tenants, and pricing strategy, stakeholders can gain deeper insights into their operational approach and potential for success in the ever-evolving real estate landscape.

Table of Contents

Related Blogs

Long-term residential operators are constantly on the lookout for the RIGHT tenant that can help add value and vibrance to the community. However, finding the

.png)